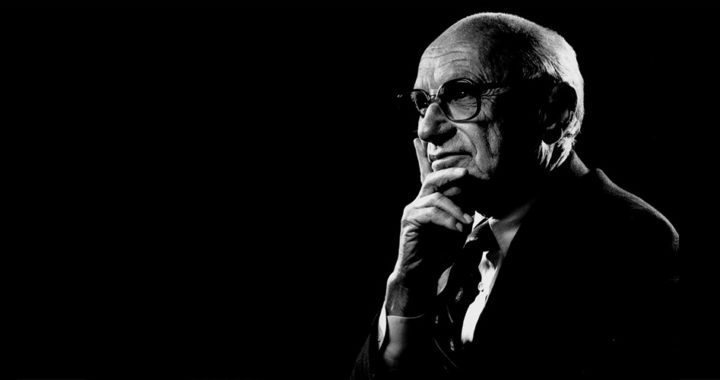

Milton Friedman was an acclaimed American economist whose contributions range from the introduction of theories and models in economics to principles and concepts in business and management. In 1976, he received the Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory, and for his demonstration of the complexity of stabilization policy.

The Major Contributions: Major Theories, Models, Principles, and Concepts Introduced by Milton Friedman

1. Free-Market Economic Theory

The concept of free-market economics did not originate from Friedman. However, through his book “Capitalism and Freedom” first published in 1962, he made it available and understandable to the public. He specifically noted that an economy based on a free-market model leads to economic freedom and political freedom, thus improving the socioeconomic status of individuals, groups or organizations, and nations or states.

2. Economic Role of the Money Supply

It is important to note that Friedman is a monetarist. He coauthored the book “A Monetary History of the United States” with another American economist Anna J. Schwartz. They both argued that inflation is always and everywhere a monetary problem. Furthermore, in referencing the U.S. as an example, they asserted that the money supply profoundly influenced the fluctuations in the American economy. They also noted that the cause of the Great Depression stemmed from the failed monetary policy of the Federal Reserves.

3. The Quantity Theory of Money

He also published the “Studies in the Quantity Theory of Money” in 1956 in which he argued that the long-term effect of increased monetary growth is an increase in prices although it has little or no impact on output. However, the short-term effect of increases in money supply growth is an increase in employment and output, while decreases would have the opposite effect. Note that Nicolaus Copernicus first introduced this theory and Friedman simply restated it as a response to John Maynard Keynes and Keynesian economics.

4. Permanent Income Hypothesis

Another major theory presented by Milton Friedman is the Permanent Income Hypothesis first introduced in his the 1957 book “Theory of the Consumption Function.” It argued against the Keynesian view that individuals and households adjust their expenditures to reflect their current income. To be specific, the theory asserts that changes in permanent income and not changes in temporary or current income are what drive changes in consumption patterns.

5. Friedman-Savage Utility Function

Together with American mathematician Leonard J. Savage, they published the paper “Utility Analysis of Choices Involving Risk” in 1948. They raised the question: why do people both buy lottery tickets and insurance against losses? Subsequently, they introduced the Friedman-Savage Utility Function, which argues that a part of the utility function is concave while another part is convex. Essentially, it helps explain why an individual is risk-loving when he or she has more wealth and why he or she is risk-averse when he or she is poorer.

6. The Economic Model of Social Responsibility

Friedman advocated for the shareholder theory of corporate social responsibility or the economic model of corporate social responsibility. In a paper he wrote for the New York Times in 1970, he argued that the sole social responsibility of a business organization is to increase its profits. A business should only engage in activities and channel all of its resources intended to increase its profitability while remaining obedient to the law.

7. Sequential Hypothesis Testing

Outside the realms of economics and business management, Friedman also co-developed a methodology for statistical analysis called the sequential analysis or sequential hypothesis testing. Developed primarily by Abraham Wild with Jacob Wolfowitz, and W. Allen Wallis, it involved an unfixed sample size and continued evaluation of data as they are collected, as well as further sampling in accordance with a predefined stopping rule.

FURTHER READINGS AND REFERENCES

- Berger, J. O. 2017. “Sequential Analysis.” The New Palgrave Dictionary of Economics. DOI: 10.1057/978-1-349-95121-5_1295-2

- Friedman, M. 1992. Capitalism and Freedom. 40th Anniversary Ed. Chicago: University of Chicago Press. ISBN: 0-226-26421-1

- Friedman, M. 1970, September 13. “The Social Responsibility of Business is to Increase its Profits.” The New York Times. Available online

- Friedman, M. 1957. A Theory of the Consumption Function. New Jersey: Princeton University Press. ISBN: 978-0-691-04182-7.

- Friedman, M. 1956. Studies in the Quantity Theory of Money. Chicago: University of Chicago Press. ISBN: 978-0226264066

- Friedman, M. and Schwartz, A. 1963. A Monetary History of the United States, 1867-1960. New Jersey: Princeton University Press

- Friedman, M. and Savage, L. J. 1948. “Utility Analysis of Choices Involving Risk.” Journal of Political Economy. 56(4): 279-304. DOI: 10.1086/256692.

- Nobel Media AB. 1976. “The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 1976: Milton Friedman.” Noble Media AB. Noble Prize. Available online

- Wald, A. 1945. “Sequential Tests of Statistical Hypotheses.” The Annals of Mathematical Studies. 16(2): 117-186. DOI: 10.1214/aoms/1177731118