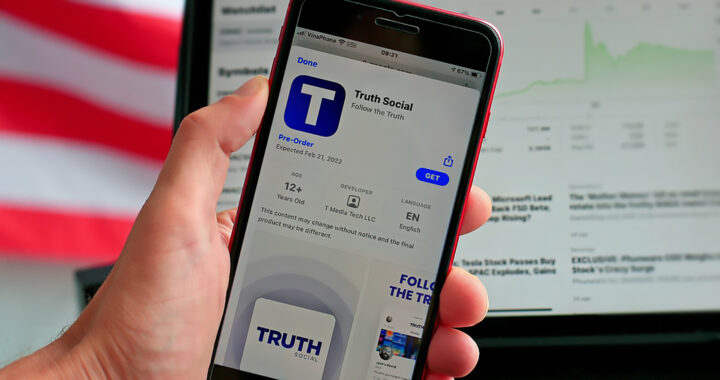

Former The Apprentice contestants Andy Litinsky and Wes Moss founded the Trump Media and Technology Group or TMTG in February 2021 with the aspiration of challenging the dominance of big tech companies and legacy media organizations. Donald Trump has since become its primary owner. The company launched the social media platform Truth Social as its flagship product in February 2022. However, despite its core product gaining traction among right-wing American internet users, TMTG is still unable to turn a profit and has been losing money.

Why is Trump Media Unable to Turn a Profit and Losing Money?

The Trump Media and Technology Group has anchored its core mission and vision on the idea of opposing big tech companies like Alphabet, Amazon, Meta Platforms, and Netflix. It has promoted Truth Social as its supposed bread and butter with the goal of opening the internet and offering an alternative to social media platforms like Facebook and Twitter or X.

It also operates the on-demand video streaming service Truth+ which was launched in October 2024 and made available via web and mobile operating systems. The company also maintains a news team via its TMTG News brand. More recent developments have revealed that it is planning to venture into cryptocurrencies and operate its own trading platform.

Financial Performance

However, despite its ambitious goals, Trump Media struggles with its finances. Its Form 10-K Annual Report for 2023 showed that it generated USD 4.13 million in revenue. This was higher than its USD 1.47 million revenue in 2022. The same report also showed that it had an operating income of USD -15.97 million and a net income of USD -58.19 million.

The low revenue is indicative of weak market demand, limited customer base, or low monetization capabilities. Its negative operating income also indicated that its operating expenses far exceeded its revenue. A negative net income significantly larger than the operating income suggests high non-operating costs like debt-related expenses or extraordinary losses.

Furthermore, for the first three quarters in 2024, the company had incurred losses. The biggest one was the USD 311 million loss from the non-cash expenses related to its merger with Digital World Acquisition Corp. It also lost USD 16.37 million in the second quarter and USD 19 million in the third quarter due to costs associated with its Truth+ streaming platform.

Trump Media also has a negative return on assets of -136.7 percent for 2023. This indicates that it lost USD 1.37 for every USD 1.00 of its assets. The company essentially not only failed to generate profits but also incurred massive losses relative to the value of those assets. This suggests that it struggled or was unable to utilize its assets effectively to generate income.

It is still worth mentioning that the 79.87 percent return on capital for 2023 indicates that it earned a high return on its core operating capital before accounting for net losses or financing costs. The stark contrast between the high return on capital and negative return on assets suggests that its overall profitability is heavily impacted by external or non-operational factors.

Short-term cash flow has also remained a problem. Its 2023 financials showed that it had a current ratio of 0.05 and a quick ratio of 0.04. It had 5 cents of current assets and 4 cents of liquid assets for every dollar of current liabilities. These indicate that Trump Media was significantly illiquid and it struggled to cover even a fraction of its short-term obligations.

The losses incurred by Trump Media in 2023 and 2024 were understandable. It remains a startup company that is still in the process of launching its products, building its core businesses, and gaining market traction. These are evident from its various substantial expansion-related expenses associated with its merger and the launching of a video streaming platform.

Specific Challenges

Note that Digital World Acquisition Corp. was considered a special purpose acquisition company created to raise capital through an initial public offering and later be acquired by or merged with another company. These companies provide startups and private companies with quicker and easier routes to getting their shares traded publicly and raising capital via the stock market.

The merger between Trump Media and Digital World Acquisition Corp. was strategic. It provided an additional avenue for raising capital via the stock market. Accessing the capital markets would enable the company to finance its operations and current initiatives and pursue its future expansion initiatives. The merits of this strategy will be determined by its future profitability.

However, as stated in its Form 10-K Report, the profitability prospects of Trump Media hinge on various factors. The company is still dependent on Truth Social. It noted in its report that the entire business is at risk if its social media platform fails to develop and maintain a sufficient number of followers or audience. Its exact number of active users is unknown.

Truth Social generates revenues via digital advertisements. This is the same business model used by platforms like Facebook, Instagram, TikTok, and X. The main problem with the flagship platform of Trump Media is that it is struggling to attract more advertisers because it does not track traditional key performance indicators like signups and active user accounts.

Forecasts for its video streaming venture are also unfavorable due to the high costs associated with building, maintaining, and expanding a content library. Companies like Netflix and Disney spend hundreds of millions of dollars each year on content acquisition and content production. Trump Media does not have enough leverage to raise this cash via the capital markets.

Even its common stock is considered speculative because of the various internal and external issues and risks that are affecting and will affect its ability to turn a profit. The price of its stock has been volatile and is often affected by news related to Donald Trump. The company admits that the appeal of its stock and its products are dependent on its namesake.

The same 2023 Form 10-K Report filed in 2024 explained that Trump Media has financed its operations mainly through loans or securities issuance and it might need additional funding in the future to further develop its products. The company acknowledges the fact that it expects to incur losses for the foreseeable future since it is an early-stage company.